Advertisement

Artificial intelligence (AI) is rapidly becoming a central tool in financial planning, particularly in enhancing return on investment (ROI). By analyzing large datasets, identifying trends, and automating key processes, AI allows businesses and investors to make faster, smarter, and more informed decisions.

This integration is not limited to one sector—it spans marketing, operations, portfolio management, and beyond. Understanding how AI contributes to ROI enables organizations to reduce costs, minimize risk, and enhance performance outcomes. This article explores what AI in ROI truly means, its most impactful applications, and the top seven ways you can use AI to improve your overall investment strategy.

AI in ROI refers to the application of artificial intelligence technologies to improve Return on Investment (ROI) across various business processes. ROI measures the profitability of an investment, and when AI is applied, it helps optimize inputs and maximize outputs, resulting in more efficient resource utilization and better returns.

AI enables automation, real-time analysis, forecasting, and decision-making that would otherwise take significant time and effort. By analyzing vast amounts of data faster than any human team could, AI identifies patterns, opportunities, and risks—helping businesses and investors make better decisions with confidence.

Here are a few real-world applications of AI that directly enhance ROI:

7 Ways AI Can Boost Your Investment Strategy:

AI enables predictive analytics that uses historical data, current trends, and real-time inputs to forecast future performance. Investors can predict stock movements, property appreciation, or consumer behavior more accurately. This minimizes risk and maximizes ROI by enabling data-driven decisions.

AI systems can automate investment decisions based on predefined goals and risk levels. Robo-advisors, such as Betterment or Wealthfront, utilize AI to automatically rebalance portfolios without requiring manual input. This improves consistency and reduces emotional decision-making, helping you stay focused on long-term returns.

AI can analyze market conditions, competitor actions, and even global events to highlight potential risks. Whether you're investing in stocks, real estate, or business operations, AI's risk detection ensures you're prepared and protected, limiting losses and maximizing gains.

AI helps reduce costs by automating routine processes, from payroll to customer service. When costs decrease and efficiency improves, the return on investment (ROI) naturally increases. For example, AI-driven accounting tools can cut financial reporting time in half, freeing up resources for growth initiatives.

AI tracks customer behavior and personalizes marketing efforts in real-time. Email campaigns, ads, and website experiences can be tailored to individual users, increasing engagement and conversions. Higher conversion rates mean more sales—boosting overall ROI without increasing marketing costs.

AI tools enable investors to monitor asset performance, analyze diversification, and optimize their holdings. Platforms like BlackRock's Aladdin use AI for portfolio risk analysis and performance simulation. This results in better portfolio choices and stronger investment outcomes.

AI collects and processes data from various sources in real-time. This enables businesses and investors to respond promptly to market fluctuations. Whether it's a stock fluctuation or a trending consumer product, real-time AI insights keep your strategy agile and ROI-focused.

AI in ROI isn't just for finance. It's transforming industries like:

Not sure where to begin? Start small:

These tools not only save time but also provide valuable insights that can inform more informed investment decisions. Additionally, they enhance customer engagement, track performance metrics in real-time, and help small businesses scale faster with fewer resources. Start by integrating just one tool and gradually build a more intelligent, AI-driven workflow that grows with your goals.

AI is no longer optional in the world of investment strategy—it's essential. By incorporating AI into your ROI planning, you gain the advantage of speed, precision, and predictive power. From more innovative analytics to automated decision-making, these seven strategies demonstrate how AI can drive better outcomes across various industries.

Whether you're a startup owner, seasoned investor, or financial planner, now is the time to leverage AI for smarter returns. Don't get left behind while others maximize their ROI with cutting-edge tools. Start exploring AI today—and transform your investment strategy for a more profitable 2025 and beyond. Ready to put AI to work? Start with one strategy today and measure your growth!

Advertisement

Explore the concept of LeRobot Community Datasets and how this ambitious project aims to become the “ImageNet” of robotics. Discover when and how a unified robotics dataset could transform the field

How the OpenAI jobs platform is changing the hiring process through AI integration. Learn what this means for job seekers and how it may reshape the future of work

How the Philadelphia Eagles Super Bowl win was accurately predicted by AI, showcasing the growing role of data-driven analysis in sports outcomes

Explore Apache Kafka use cases in real-world scenarios and follow this detailed Kafka installation guide to set up your own event streaming platform

Advertisement

Learn 5 simple steps to protect your data, build trust, and ensure safe, fair AI use in today's digital world.

Bias in generative AI starts with the data and carries through to training and outputs. Here's how teams audit, adjust, and monitor systems to make them more fair and accurate

The future of robots and robotics is transforming daily life through smarter machines that think, learn, and assist. From healthcare to space exploration, robotics technology is reshaping how humans work, connect, and solve real-world challenges

What makes StarCoder2 and The Stack v2 different from other models? They're built with transparency, balanced performance, and practical use in mind—without hiding how they work

Advertisement

AI content detectors don’t work reliably and often mislabel human writing. Learn why these tools are flawed, how false positives happen, and what smarter alternatives look like

Looking for simple ways to export and share your ChatGPT history? These 4 tools help you save, manage, and share your conversations without hassle

Rockwell Automation introduced its AI-powered digital twins at Hannover Messe 2025, offering real-time, adaptive virtual models to improve manufacturing efficiency and reliability across industries

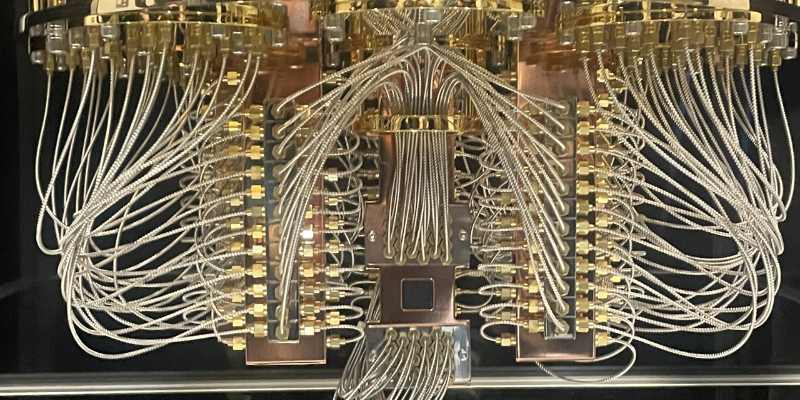

Explore the current state of quantum computing, its challenges, progress, and future impact on science, business, and technology